Fortify AI – Pioneering 3D AI Agents and Monetized Crypto Portals

Fortify AI (Twitter: @FortifyAILive) is an emerging low-cap crypto project blending cutting-edge AI technology with Web3 community platforms. It offers a suite of tools centered around adaptive 3D AI agents and token-gated portals to help crypto communities and content creators engage users and monetize participation in new ways. This bullish deep dive explores Fortify AI’s core value propositions – from its custom 3D AI avatars and secure multi-chain portals to the $FAI token’s utility – and why these strengths position it as a potential gem for pro-crypto investors. (For a quick overview, see the summary table below before we unpack the details.)

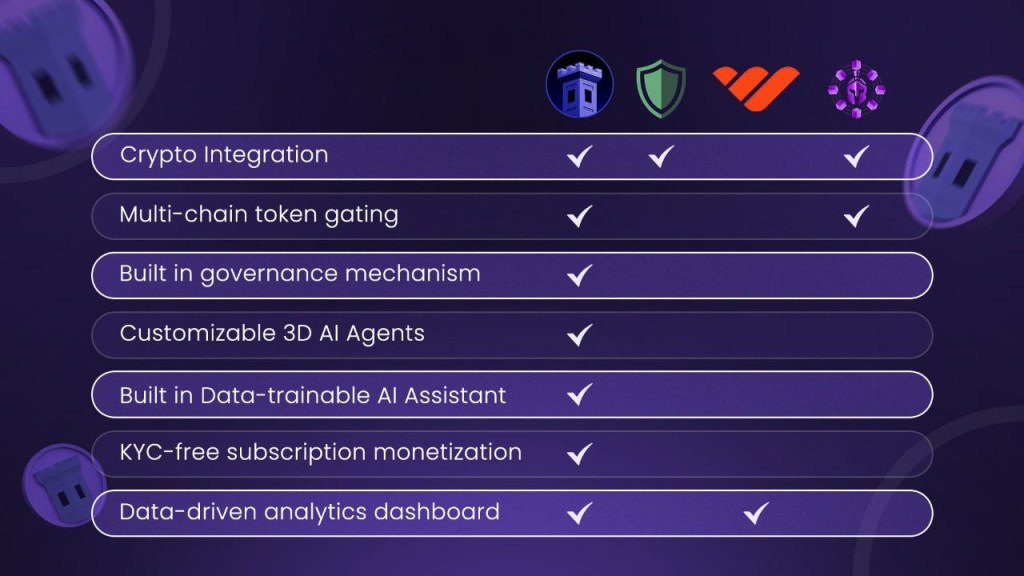

Key Utilities & Strengths at a Glance

Fortify AI Feature/Utility

Strength & Benefit

3D Adaptive AI Agents

Interactive on-chain avatars with custom appearances, emotions, voice & animations for immersive user engagement . Agents can even fetch on-chain data and interact with each other, creating dynamic experiences tailored to a brand or community .

Next-Gen Token-Gated Portals

Secure, multi-level token gating for community portals (basic login, ERC-20, or NFT-based access) with multi-chain support (ETH, BTC, SOL) . Ensures exclusive access for holders and fans, strengthening community security and loyalty.

Subscription Monetization Tools

Built-in system to create tiered subscription groups (weekly/monthly payments) and accept crypto payments . Empowers creators and projects to unlock recurring revenue streams from their audience directly on the platform (no third-party required).

In-Platform Governance

DAO-style governance mechanisms integrated into portals , allowing $FAI token holders to have a say in community decisions. Enhances trust and decentralization by involving the community in project governance.

Advanced AI & Crypto Analytics

Data-driven insights dashboards with real-time metrics: user engagement, subscription usage, token performance (market cap vs time, holder growth), “Hunger-Greed” sentiment index, AI chat summaries, and more . Helps optimize community growth and understand investor sentiment.

$FAI Token with Rewards

$FAI has a 1 billion supply and a modest 5% buy/sell tax that funds the ecosystem . Holders (≥500k FAI) get weekly revenue-sharing from platform income (ads, fees) , plus 20% of tax goes to weekly buybacks and burns that can reduce supply – incentivizing long-term holding.

Broad Integrations & Partners

Fortify AI is designed to work across Web2 and Web3. It’s already partnering with other crypto projects (e.g. in DeFi ecosystems) and tapping into a $100B+ creator economy (OnlyFans, streaming, VTubers) by offering 24/7 AI engagement for their audiences . This cross-sector approach vastly expands its user base potential.

Fortify AI’s Vision and Value Proposition

Fortify AI’s vision is to be an all-in-one platform for interactive AI-driven communities. According to the official description, Fortify AI is “the first platform offering custom-trained, on-chain 3D customizable AI agents with seamless integration across several platforms for communities, creators, and businesses.” In practice, this means a project or creator can quickly deploy a branded portal (web-based community hub) that comes with a 3D AI “mascot” trained on custom data, and gated entry for members based on tokens or subscriptions. Fortify AI packs in all the infrastructure needed – multi-secure token gating, multi-chain support, an inbuilt governance system, advanced analytics, and subscription-based monetization – effectively everything needed to run a Web3 community or crypto-centric business in one secure platform .

This value proposition is especially powerful for crypto projects, DAOs, and influencers who struggle to combine engagement, security, and monetization. Fortify AI’s 3D AI agents serve as intelligent virtual hosts or assistants, its token-gated portals ensure exclusive access to content or chats for holders, and its monetization tools allow setting up paid membership tiers with ease. By integrating these, Fortify AI enables new forms of user interaction (imagine an AI community manager that greets users or answers FAQs 24/7) while also creating new revenue streams for the community organizers. It’s a comprehensive approach that marries the viral appeal of AI avatars with the incentives of crypto token economies.

Notably, Fortify’s scope isn’t limited to crypto circles – it explicitly targets mainstream creator communities as well. The team highlights a “massive, largely untapped $100+ billion market” of content creators on platforms like OnlyFans, Twitch/YouTube streamers, Instagram models, and VTubers, who could use custom 3D AI agents to engage fans around the clock . Fans might interact with a creator’s AI persona at any hour, while the creator earns via subscriptions or token access – a novel form of monetization. By bridging Web2 creators and Web3 tech, Fortify AI’s platform could onboard far more users into crypto than a typical blockchain project, all while providing value to creators through automation and new income.

Core Features: 3D AI Agents, Secure Portals, and Analytics

Fortify AI’s platform is rich with features, each adding to its competitive moat. Some of the core features and services include:

Custom 3D AI Agents: Fortify’s flagship feature is its adaptive 3D AI avatars – think of them as intelligent digital mascots or assistants for your project. These agents are fully customizable in appearance and behavior. You can train them with your project’s specific data (documents, FAQs, lore, etc.) so they speak your brand’s language . They support emotions, facial animations, and voice, making interactions feel natural and engaging . Uniquely, they can even fetch on-chain data on command – for example, a user could ask the AI agent about the project’s token price or holder count and get real-time answers from blockchain data . Multiple 3D agents can also be deployed to simulate live interactions, such as an AI-run AMA or even two AI avatars having a scripted discussion to entertain or inform the community . This level of interactivity is unheard of in most crypto projects and gives Fortify AI a “wow” factor in user experience. Next-Gen Token-Gated Portals: Alongside the AI agents, Fortify provides an intuitive way to spin up web portals or chat groups that are gated by various authentication methods. Community leaders can require simple logins, or enforce that users hold certain tokens or NFTs to gain access . The gating system is multi-level and multi-chain: you could have different content tiers (e.g., free, bronze, silver, gold) unlocked by holding different amounts of a token or specific NFTs, and Fortify supports assets on Ethereum, Bitcoin, Solana and more . This flexible gating is baked into the platform UI, so you don’t need complex bot setups – a huge plus for crypto communities that currently rely on third-party Discord/Telegram bots for token verification. By securing content and chat access, communities can ensure only invested members participate, reducing spam and rewarding those who hold tokens.

Subscription Monetization: For creators and project teams, Fortify AI includes ready-made tools to launch subscription-based groups or content paywalls. Through a simple dashboard, a creator could set up a members-only forum or Telegram channel and charge a weekly or monthly fee in crypto for access . Payments can be in various coins (with plans for multi-chain crypto payments) to accommodate different audiences . This essentially mimics platforms like Patreon or OnlyFans but on a decentralized stack – creators keep more control and potentially more profit. Given that Fortify’s AI agents can keep subscribers engaged (answering questions, providing updates), fans might be more willing to pay for these private groups. The ability to combine token gating with paid subscriptions is powerful: a project could, for example, require holding its token and/or paying a fee for premium content, layering multiple monetization models. Fortify’s Medium blog even suggests their crypto-based subscription system could compete with Web2 solutions like Whop.co for managing memberships , underscoring how the project sees itself overtaking traditional tools. Built-in Governance and Security: Community governance is another pillar of Fortify’s platform. Each portal comes with an inbuilt governance mechanism – essentially tools to poll or let token holders vote on decisions . This means projects can turn their portal into a mini-DAO, using $FAI or their own tokens for voting weight. Having this on-site is a convenience (no need for separate Snapshot pages, for instance). On the security front, Fortify emphasizes “Multi-Secure” gating: owners can stack login requirements (password + token + NFT if desired) for extra security . All these features being native to the platform reduces reliance on external bots/scripts and the associated risks. Advanced Analytics Suite: Data is key to improving any community or product, and Fortify AI provides a robust analytics dashboard built into the portals. Project owners get real-time tracking of token performance and community metrics . For example, you can view charts of market cap or holder count over time, and correlate them with engagement levels – useful to see if a marketing push led to more holders. The platform also offers AI-driven analytics like a “Hunger-Greed Index” (likely a sentiment gauge for your community or market) and sentiment analysis of chat, plus AI that can summarize chat discussions . On-chain analytics are included too, such as identifying “smart” holder wallets and tracking their activity . For creators, there are subscription usage metrics showing how subscribers interact, which content retains them, etc. . These insights help community managers tweak their strategy and demonstrate Fortify’s focus on data-driven growth.

All these features work in concert. Imagine a crypto project’s portal: new users arrive and are greeted by a friendly 3D AI agent that explains the project and answers questions. To dive deeper, users must hold the project’s token or pay a subscription, at which point the portal unlocks exclusive forums, AI-powered market analytics, and governance polls. The project team monitors the analytics dashboard to see community health, while token holders know that as engagement grows, they earn a slice of revenue via $FAI rewards. This cohesive ecosystem is what makes Fortify AI stand out in terms of utility.

$FAI Token Utility and Ecosystem Role

At the heart of Fortify AI’s ecosystem is the $FAI token, which not only fuels the platform’s economy but also rewards its community of holders. $FAI (Fortify AI’s native token) has a fixed supply of 1 billion tokens , and importantly, the team has designed it with value accrual mechanisms to align with platform growth:

Revenue Sharing to Holders: Fortify has a built-in revenue distribution model: 20% of all platform revenue (from advertising, service fees, white-label partnerships, etc.) is pooled and paid out to $FAI holders on a regular basis . To qualify, a holder must own at least 500,000 FAI (which, at current prices, is an accessible threshold for early investors). This means as Fortify’s user base and revenues grow, dedicated token holders directly share in the profits – a strong incentive to stick around long-term. Few crypto projects offer actual revenue sharing like this, making $FAI attractive for those seeking passive income from ecosystem success. Weekly Buyback and Burn: The smart contract imposes a modest 5% tax on buys and sells of $FAI (often called a 5/5 tax) . A portion of these taxed funds (20% of the tax, i.e. 1% of each transaction) is used by the team to buy back $FAI from the market every week, and those bought tokens are then burned (destroyed) . This mechanism creates consistent buying pressure and reduces supply over time, which can support the token price if trading activity is high. Another portion of the tax (another 20%) feeds the revenue-share pool mentioned above , while the remaining goes to marketing and development (30% each) to ensure the project is well-funded . In summary, every transaction in $FAI helps fund growth and rewards, aligning network activity with investor interests. Governance and Utility: Beyond passive rewards, $FAI likely plays a role in governance (e.g. voting on feature upgrades or portal policies could be done with $FAI holdings weighting votes, given the inbuilt governance system). It may also unlock certain platform features – for instance, Fortify could require project owners to stake $FAI to deploy advanced AI agents or to get higher revenue share tiers. While full details of governance utility aren’t yet public, the whitepaper emphasizes Fortify’s unique combination of governance + AI + gating , hinting that the token is a key to accessing or configuring these features. Additionally, because Fortify’s portals allow token-based group gating, communities might even use $FAI itself as the access token for special sections, driving demand as more groups adopt the platform. Ecosystem Integrations: $FAI is already live and trading on Ethereum (Uniswap v2 is the primary DEX so far ). It’s listed in the AI Applications category on CoinGecko , and as of now the project is still truly under the radar – with a fully diluted market cap of only ~$50k (ranked around #6818 on CoinGecko) . This low market cap means even modest adoption of the platform could multiply $FAI’s value, though of course it also means liquidity is currently limited (24h volume is only a few thousand dollars , typical for an early-stage project). The team has applied or plans to apply for listings on bigger platforms (CoinMarketCap, etc., per their roadmap), which could improve accessibility. In the meantime, interested users can acquire $FAI on Uniswap and add it to their Web3 wallets (the contract address is public on Ethereum ). The token is also trackable on popular DEX analytics like DexTools and Dexscreener , signaling that the infrastructure for trading and monitoring is in place.

In summary, $FAI is the economic glue that ties the Fortify AI ecosystem together: it incentivizes holding through revenue dividends and scarcity (buybacks), it potentially grants governance rights and premium access, and it benefits directly from platform growth. For investors, $FAI offers a way to bet on the success of Fortify’s AI platform with tangible rewards along the way – a model that aligns well with the interests of community-centric crypto holders. The tax-and-reward design is similar to other successful micro-cap projects that grew communities by rewarding diamond hands, but Fortify has the advantage of a strong underlying product to drive those rewards.

User Engagement & Monetization Edge

One of the strongest bullish arguments for Fortify AI is how its technology can massively boost user engagement and monetization for communities. In crypto (and online communities in general), keeping people active and invested is gold. Fortify’s approach with 3D AI agents and interactive portals provides an engagement toolkit that few others offer:

24/7 Community Interaction: A Fortify AI agent can be present at all hours in a community portal or Telegram group (indeed, Fortify has a live demo bot on Telegram ). This means even when team members or influencers are asleep, there is an always-on AI representative to answer questions, welcome newcomers, or even entertain the chat. New users get instant responses instead of waiting for a moderator. For example, a late-night visitor could ask the AI, “What’s the use case of this project?” and get a coherent answer sourced from the project’s docs. This kind of immediate, intelligent response can significantly improve newcomer conversion and overall community satisfaction. It’s like having a tireless community manager who never takes a break. Personalized Engagement at Scale: Because each AI agent can be trained on project-specific data, the interactions feel highly personalized . In contrast, many projects might use generic AI chatbots (e.g. GPT-based) that don’t know the project’s details. Fortify agents do know your project intimately (after you train them with your content), making their responses far more relevant. Moreover, their ability to express emotions and use voice means they can convey the tone of the brand (imagine a friendly mascot character with a unique voice, versus plain text replies). This fosters a stronger emotional connection with the community. Users might actually enjoy chatting with the project’s AI avatar, increasing the time they spend in the ecosystem.

Monetization Without Alienating Users: Traditional monetization (ads, paywalls) can hurt user experience. Fortify’s model is clever: it monetizes through engagement itself. Fans or investors pay to access more content or closer interaction (which they want), and in doing so fund the project and even themselves (via token hold rewards). Because the value exchange is clear – exclusive access or premium AI services in return for a fee or token stake – users are more willing to pay, compared to say, being forced to watch ads. The subscription groups mean a project can earn recurring revenue from its most loyal members, which is more sustainable than one-off NFT mints or token sales. And since Fortify supports crypto payments natively , even traditional creators can tap global audiences without friction (no bank needed, a fan with some crypto can subscribe in one click). This opens monetization to markets that couldn’t access platforms like Patreon due to payment barriers.

Examples of Use Cases: Consider a DeFi project integrating Fortify: They launch a token-gated portal where $FAI and their own token are used. Inside, an AI assistant provides users with real-time DeFi analytics (using Fortify’s on-chain data features) – ask “What’s our TVL today?” and get an answer plus a chart. The portal also has a paid VIP section where the AI gives personalized portfolio tips or schedules alerts for big transactions. Users happily pay or hold tokens for these perks, boosting the project’s treasury and token demand. On the other side, imagine a popular crypto influencer or trader who usually sells calls on Telegram. With Fortify, they create a private AI-powered chat where subscribers not only get the human’s calls but can also query the AI for analysis on any coin, 24/7. This “value-add” could justify higher subscription prices, benefiting the influencer while giving subscribers more bang for their buck.

Mainstream Creator Angle: The engagement edge extends beyond crypto. For a Web2 content creator (say a gaming streamer), deploying a Fortify AI agent could be revolutionary. Fans could join a portal where the creator’s 3D avatar (trained on the creator’s personality and content) chats with them as if it were the creator themselves. It can call users by name, recall past conversations (thanks to AI memory), and keep fans entertained between the creator’s live streams. This enables 24/7 fan engagement, essentially letting creators be with their audience even while they sleep. Fortify’s team explicitly mentions this use: “3D AI agents [tap] into a massive…market of OnlyFans creators, streamers and VTubers, enabling 24/7 audience interaction through custom 3D AI agents that monetize engagement.” . A creator could monetize this by charging a membership fee to chat with the AI or to see exclusive AI-generated content. It’s easy to see many fans paying for a chance at a personal conversation (even if AI) with their favorite influencer’s persona. This translates to potentially huge revenue for creators and thereby usage for Fortify’s platform.

In short, Fortify AI provides an engagement loop that benefits all parties: users get richer interactions and communities feel alive at all times; project owners and creators earn more from those interactions; and the Fortify platform grows with each new group or creator onboarded. This positive feedback cycle could give Fortify a significant edge in user retention compared to other communities. Rather than a static forum or a Discord that goes silent during off-hours, a Fortify-powered community is always active. If the broader crypto market catches on to this advantage, we could see a wave of communities migrating to Fortify’s ecosystem for the engagement boost alone.

How Fortify AI Stands Out from Other AI Crypto Projects

The crypto space saw a surge of “AI projects” in the past year, but Fortify AI truly differentiates itself with its unique blend of features and clear use-case focus. Here are a few key differentiators that set Fortify apart from the typical AI crypto project:

Interactive 3D AI vs. Text-based Bots: Many crypto AI projects revolve around chatbots (text-based assistants) or AI algorithms for trading. Fortify AI, however, delivers immersive 3D AI characters that users can see and hear. These aren’t just disembodied AI voices or Telegram bot commands – they are visual, lifelike avatars that can exist on web portals, potentially in VR/AR or games in the future. This makes the AI experience far more engaging. It’s the difference between chatting with a blank prompt and hanging out with a virtual character. This entertainment factor gives Fortify an edge in capturing user interest (and also opens up branding opportunities – communities can design unique avatars as their “mascot”). Technologically, supporting 3D models, animations, and real-time AI responses is a complex feat (as outlined in Fortify’s own architecture posts ), indicating a high level of development compared to simpler chatbot projects.

On-Chain Integration and Crypto Focus: Unlike generic AI platforms, Fortify’s agents are crypto-native. They can pull data from blockchains and understand token holdings for authentication . The platform itself is built with crypto communities in mind (token gating, wallet connections, on-chain analytics). Competing AI projects might offer AI services but not integrate with on-chain data or wallets out of the box. Fortify’s comprehensive approach (AI + blockchain + governance + payments) is rare. As the team describes, “FORTIFY AI goes beyond basic token and NFT-based authentication by offering in-built governance mechanisms, custom-trainable 3D AI agents or bot assistants, on-chain data insights, and crypto subscription plans – a unique combination providing dynamic, secure, and data-driven user experiences.” . This all-in-one combination is a major differentiator; where others provide just an AI API or just a token gating service, Fortify provides the entire stack in one platform. Bridging Web2 and Web3: Fortify AI actively targets Web2 creators and businesses, not limiting its market to crypto enthusiasts. Many AI crypto projects market themselves as infrastructure for other crypto developers or as AI marketplaces for blockchain. Fortify instead built an end-user-facing product that could be used by a Twitch streamer with zero blockchain knowledge (their fans might pay in crypto without the streamer needing to code anything). This strategy opens Fortify to a vastly larger user base. It also helps crypto adoption by giving Web2 users a reason (monetization) to use a crypto platform. Competitors like SingularityNET or Fetch.ai focus on AI services for crypto, whereas Fortify is leveraging crypto to deliver AI services to mainstream users. This bidirectional appeal (Web3 tech + Web2 users) could make Fortify a leader in actual user adoption. The FAQ explicitly states Fortify “is designed for integration across multiple ecosystems, not just crypto”, enhancing Web2 projects as well . Tangible Product from Day One: It’s worth noting that Fortify AI already has working components – the Telegram AI bot, the portals (in beta), etc. – whereas many AI projects launched tokens on promises of future tech. Fortify has shown demos of its 3D agents in action and has a functional platform in testing. For example, community members can interact with @FortifyAILiveBot on Telegram right now to get a feel for the AI. This lowers execution risk compared to projects still building core tech. It also means Fortify can start generating revenue (through subscriptions or white-label deals) earlier. The presence of partnerships (AltCTRL, UniLend Finance, and others in crypto have acknowledged Fortify ) suggests the industry recognizes its product. In contrast, many hyped “AI tokens” were simply riding the trend with nothing to show. Fortify’s solid development progress and early integrations make it stand out as a serious, utility-driven project in a field crowded with hype.

Community-Centric Tokenomics: Fortify’s token model (revenue share + buyback) is designed to reward community participation directly, which isn’t common among AI projects. For instance, holders of SingularityNET’s AGIX or Ocean Protocol don’t get a slice of those platforms’ revenue; their value is more speculative. $FAI is structured more like a growth share in the platform’s success – if Fortify AI gets widespread adoption, holders get both appreciation and dividend-like perks. This could attract a different class of investor who is interested in cash flows, not just token price swings. It aligns the community to actively promote and use the platform (since more usage = more revenue shared).

In summary, Fortify AI is carving out a niche at the intersection of AI avatars, community management, and crypto monetization. It doesn’t really have apples-to-apples competitors – it’s competing a bit with AI chatbot providers, a bit with community management tools, and a bit with creator monetization platforms, but by combining these, it offers a novel service. As a result, Fortify enjoys a first-mover advantage in this blended domain. Of course, success will invite competition, but Fortify’s head start and integrated approach could make it the platform to beat for any future copycats. For now, it stands out strongly from other AI crypto projects by actually delivering a usable product that addresses real needs in crypto communities and beyond.

Community Involvement and Roadmap Progress

A project’s strength is not just in tech but in its community and execution of roadmap milestones. Fortify AI shows encouraging signs on both fronts:

Growing Community & Social Presence: Fortify’s community channels are active and growing. The official Telegram group (branded as Fortify AI Portal on Telegram) brings together supporters, and the team shares updates via a dedicated Telegram announcement channel as well . On Twitter (X), @FortifyAILive regularly posts updates and has been engaging with crypto audiences, which has led to a network of influencers discussing $FAI. Early adopters – the low-cap hunters – have already formed a base, as evidenced by social media mentions (several crypto enthusiasts on Twitter have highlighted Fortify’s unique offering of “3D AI mascots” and even posted clips/images of the AI in action). This word-of-mouth is crucial for a low-cap project’s initial growth. Moreover, the interactive nature of Fortify’s tech means community members often share their experiences with the AI bot, effectively creating user-generated promotion. The community is not just passively holding the token; they can use the product (train the bot, test portals) and provide feedback, fostering a sense of involvement in the project’s development.

Partnerships and Ecosystem Alliances: Despite being new, Fortify AI has already attracted partnerships in the crypto space. Notably, it was welcomed into the UniLend Finance ecosystem (a DeFi platform), indicating a potential collaboration on bringing Fortify’s AI services to UniLend’s community . It’s also been highlighted by AltCTRL, a project mentioned in Fortify’s roadmap (Phase 3 includes an AltCTRL staking farm ), suggesting a strategic alliance there. These partnerships can accelerate Fortify’s adoption by leveraging established user bases. For example, if UniLend or others integrate Fortify’s AI agents on their platforms, it showcases Fortify’s capabilities to thousands of new users. The “Powered by Fortify AI” partnership approach (as seen by the array of partner logos on Fortify’s website , including names like AGIX (SingularityNET) and others) indicates Fortify is building a broad coalition in the AI x crypto industry. Such connections lend credibility and may lead to exchange listings or co-marketing in the future.

Roadmap Execution: Fortify AI’s roadmap is divided into clear phases, and they have been hitting their milestones methodically. Phase 1, which encompassed the product’s core development, saw the creation of the cross-chain portal system with token/NFT gating, the custom 3D AI agent engine, and built-in governance tools . By the end of Phase 1, a beta release of a custom-trained 3D AI agent was deployed – a promise the team delivered on as evidenced by the functioning AI bot. They also underwent stress testing and an audit, laying a solid technical foundation. The successful launch of the $FAI token in early 2025 aligns with the transition to Phase 2. Phase 2 focuses on expansion and user-facing enhancements now that the token is live. According to the roadmap, the team is working on an AI-as-a-Service (AI-AaaS) dApp platform so that anyone (even non-coders) can customize and deploy their own 3D AI agents easily . They are also enhancing the AI agents with more immersive animations and environments, which could make portals feel like mini virtual worlds . An exciting planned feature is simulating live 3D AI podcasts about crypto projects – imagine tuning into a talk show run entirely by AI avatars discussing the latest market trends! Additionally, Phase 2 includes rolling out a creator dashboard for tracking subscription metrics and managing plans , as well as aggressive partnerships and onboarding of Web2 creators (think VTubers and streamers collaborating with Fortify to launch AI versions of themselves) . This phase is all about proving product-market fit and scaling the user base. Looking further ahead, Phase 3 sets sights on refining the ecosystem and adding more value for token holders. Plans include an AltCTRL staking farm with wETH rewards (likely allowing $FAI holders to stake and earn yield in wrapped ETH) and a Fortify AI “trending services” dashboard that tracks trending tokens and smart money wallets, with alerts – this could attract traders to use Fortify’s portal for analytics. Advanced on-chain analytics algorithms are in the works, as is a referral system to incentivize users to spread the word (referrals both for the AI agent service and the token gating platform) . The team also leaves room for “further innovations” in Phase 3, showing they intend to remain adaptive to new opportunities.

Current Status: As of Q2 2025, Fortify AI has a working product in beta, a token that’s trading, and is steadily building out the more advanced features from its roadmap. The weekly buybacks and revenue sharing have reportedly begun, with a “Buybacks” tracker in their GitBook updating the community on how much $FAI has been bought/burned so far . This transparency helps build trust. The community has been growing, albeit from a small base – which is expected at this stage – and sentiment in their channels is positive, with early users often sharing successes (for instance, community members have trained the AI bot to answer detailed questions about Fortify’s whitepaper, demonstrating the platform’s capability and the community’s enthusiasm).

In summary, Fortify AI is executing on its roadmap at a steady pace and engaging its community through each step. They have shown the ability to form partnerships and adapt their offerings (e.g., prioritizing the subscription platform after seeing the Web2 potential). The roadmap gives a clear trajectory of where the project is headed, and so far, milestones are being met – a reassuring sign for any investor.

Scalability and Long-Term Adoption Potential

From a long-term perspective, Fortify AI presents a compelling growth story if it continues on its current trajectory. A few factors contribute to its scalability and adoption potential:

Huge Addressable Markets: Fortify sits at the crossroads of multiple large markets – the crypto community market (thousands of projects needing better community tools), the content creator economy (millions of creators looking to monetize audiences), and the burgeoning AI/virtual assistant market (businesses seeking AI customer support, etc.). Even capturing a tiny slice of each could drive significant usage. The fact that Fortify’s tech appeals to both crypto-native users and mainstream users gives it a bigger addressable market than projects confined to one domain. As mentioned, the creator economy alone is a $100B+ opportunity . Crypto itself is global with over 300 million users now – many of whom congregate in Telegram/Discord communities that could be enhanced by Fortify’s platform. If Fortify succeeds, it could become as ubiquitous as, say, Collab.Land (the token-gating bot used in countless groups) or even challenge Patreon/OnlyFans in the long run for a share of creator monetization, which would be enormously bullish for $FAI demand. Modular and Scalable Architecture: Fortify AI’s design is modular, scalable, and built to handle diverse applications . This is evident from how the system is described – separate classes for avatar rendering, AI brain, voice, deployment, etc., which means it can be updated or scaled piece by piece. The team can deploy many AI agents across different portals without them interfering, and they can integrate new AI models as needed (for example, swapping in a more advanced language model down the line). The use of on-chain data is efficient and can leverage oracles if needed for speed. In short, from a technical standpoint, Fortify can scale users without a complete overhaul. The multi-chain support also means it isn’t bottlenecked by one network’s throughput – communities on Solana or Layer-2s could use it cheaply, while Ethereum-based communities can also participate. This flexibility bodes well for handling growth.

Network Effects of Communities: If Fortify AI gains traction, network effects could kick in. Consider that a user who learns how to use one Fortify-powered portal (say, how to interact with the AI agent and navigate the UI) will have an easier time joining another Fortify-powered community. Their wallet might already be configured, their $FAI tokens held for perks, etc. This reduces friction for each new community adopting Fortify. Likewise, creators talk to each other – if a few big influencers successfully monetize using Fortify, others will follow to not miss out. Crypto project leaders often join multiple communities; if they see a good Fortify implementation somewhere, they might adopt it for their own project. Over time, Fortify AI could become a standard toolkit for crypto community management, much like how certain bots (Tip.cc for tipping, for example) became standard in many groups. Standardization can lead to a virtuous cycle: Fortify’s brand becomes known for high engagement communities, so users seek out Fortify-enabled groups, which in turn encourages more groups to use Fortify.

Low Market Cap Upside: From an investment standpoint, Fortify AI’s current micro-cap status leaves massive room for growth if the project delivers. With a market cap in the tens of thousands of dollars and rank in the 6000s on CoinGecko , it is practically undiscovered. Comparable AI projects that gained traction reached market caps in the tens or hundreds of millions. For instance, tokens in the AI sector (like AGIX, FET, or smaller ones like ALI, etc.) saw huge runs when they hit the narrative right. Fortify AI uniquely ties into multiple narratives: AI, crypto community tooling, and creator economy – any one of which could spark investor interest. As the team rolls out more features (like the AI-AaaS platform and partnerships in Phase 2), news flow could attract new investors and significantly re-rate $FAI’s value. In bull market conditions, low-cap projects with a working product and strong narrative can see exponential growth. While nothing is guaranteed in crypto, the asymmetry is clear: the downside is limited to the small market cap, while the upside could be enormous if Fortify captures even a modest user base. Long-Term Adoption and Vision: Fortify AI’s long-term vision seems to extend beyond the immediate roadmap. The idea of “Agents as a Service” (AaaS) could morph into a platform where businesses license AI agents for customer support, or where every crypto project launches an AI community manager as a norm. If Fortify can become the backend for those services, it could generate significant recurring revenue (which again flows to token holders). Additionally, as VR and the metaverse concepts mature, Fortify’s 3D agents are well-positioned for those environments – potentially these agents could populate virtual worlds, providing information or entertainment, which opens another frontier. The team’s willingness to cater to Web2 shows a pragmatic approach to adoption (not waiting for the whole world to become Web3-savvy). This hybrid strategy increases the probability of long-term success.

Risks and Challenges: No analysis is complete without noting that Fortify AI will face challenges. They need to continually improve the AI quality to meet user expectations (AI tech is advancing fast, so staying cutting-edge is essential). They also must market effectively to break into creator communities which have existing platforms. And being a micro-cap, they must manage security (smart contract risks) diligently to avoid any exploit that could derail trust. However, the team’s actions so far (security audits, phased development, community transparency) indicate they are aware of these factors. If they continue to execute well, Fortify AI has a credible path to becoming a major platform at the intersection of AI and crypto.

Conclusion: A Bullish Outlook

Fortify AI brings something genuinely novel to the crypto sphere – a fusion of AI-powered engagement and crypto-powered incentive structures. By enabling custom 3D AI agents, secure token-gated communities, and built-in monetization, it addresses real needs of both crypto projects and content creators. The $FAI token ties it all together, giving investors a stake in the platform’s success with features like revenue sharing and buybacks that are seldom seen in the industry. Importantly, Fortify AI isn’t just selling a vision; it has already rolled out key components and shown that the tech works, all while sitting at a tiny market valuation.

For pro-crypto retail investors and low-cap enthusiasts, Fortify AI represents the kind of high-upside opportunity that comes around rarely – a project at the nexus of multiple high-growth trends (AI avatars, community management, creator economy) that is still flying under the radar. The roadmap ahead suggests continuous news flow and expansion, from onboarding Web2 influencers to releasing the self-service AI agent platform and more analytics features. Each step could substantially grow the user base and by extension the demand for $FAI tokens (for access, for holding rewards, etc.).

While investors should always do their own due diligence, the analytical case for Fortify AI is strong: it has clear utility, a passionate community, a competent execution so far, and a differentiated product in a crowded market. In a crypto world that often sees pure hype, Fortify AI offers a refreshingly concrete value proposition – one that could translate into sustained growth.

In summary, Fortify AI stands out as a bullish contender in the AI x Crypto arena, combining the sizzle of interactive 3D AI with the substance of a revenue-generating platform. If it continues on its current path, Fortify AI could very well fortify its position as a leader in next-gen crypto communities, rewarding both its users and its investors in the process.

One thought on “Fortify AI – Pioneering 3D AI Agents”