$SOTT: A Rising Star in Crypto Real Estate with AI and Fractional Ownership

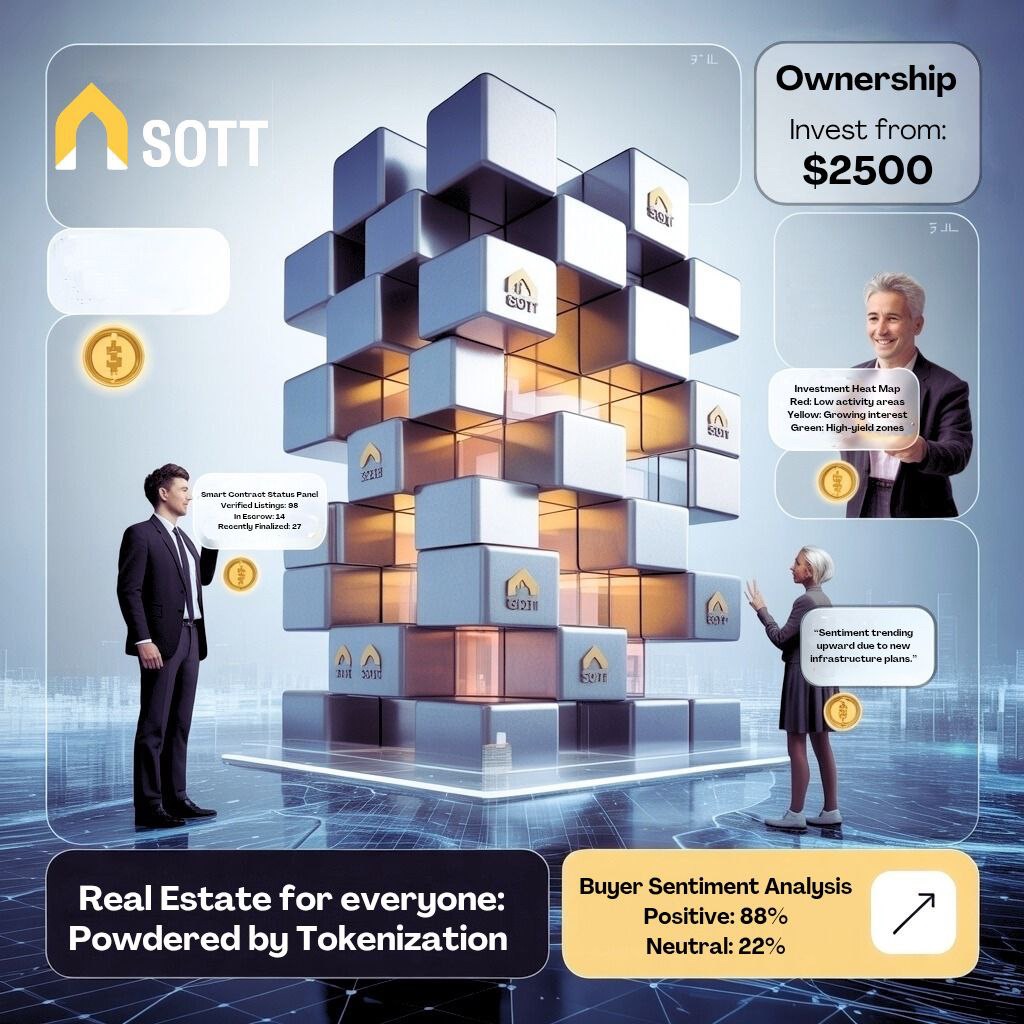

As tokenized real estate gains traction in crypto, a new project is quietly carving out its niche: $SOTT, short for SOTT crypto real estate marketplace token. With a blend of blockchain transparency, AI efficiency, and fractional ownership, $SOTT aims to democratize real estate investment and redefine how people buy, sell, and profit from property.

Despite limited mainstream exposure and an inaccessible website as of late May 2025, $SOTT is gathering momentum via its active X (Twitter) presence. In this deep dive, we’ll break down what makes $SOTT unique, how it stacks up against real estate token competitors like RealT and HoneyBricks, and what risks and rewards lie ahead for early adopters.

A Marketplace Token for Modern Real Estate

$SOTT is designed to simplify and globalize property transactions. The token allows users to purchase fractional ownership in real estate—ranging from apartment units to entire construction projects—starting from as little as $10. It leverages blockchain for transparent asset management and AI for smart property discovery.

Some of its standout features include:

AI-powered agents and voice assistants for personalized property search. Zero-Knowledge Proofs (ZK-proofs) for secure, private transactions. NFTs that generate royalties (e.g., “The Titan’s Grip” offers 1% of all token transactions to holders). Cashback and profit-sharing tied to in-app purchases and activity. Mobile app access, already available via AppStore and PlayMarket, per X posts from May 2025.

Key Use Cases and Utility

From a user perspective, $SOTT offers several real-world applications:

Private real estate deals executed via smart contracts. Low-barrier investing in global properties and large-scale developments. Passive income through NFTs tied to platform transaction volumes. On-the-go asset management through the mobile app interface.

The integration of Google’s AI API, as referenced in X posts, allows for dynamic filtering of listings. Imagine saying, “Show me properties in Portugal under $100,000 with ocean views,” and getting tokenized investment opportunities delivered instantly.

Tokenomics and Market Status

$SOTT remains under the radar, as it’s currently not listed on CoinMarketCap or CoinGecko, which suggests early-stage positioning. According to X posts by @PeraniumP:

Token supply is limited to boost scarcity. Token value increases with every in-app transaction. NFTs distribute revenue back to holders as a reward for early support.

Its growth model appears tied to real user engagement and platform transaction volume rather than speculative hype. This utility-based approach sets it apart from meme-driven tokens in the same market cap range.

Comparing $SOTT with RealT, HoneyBricks, and RealOpen

In a competitive space, $SOTT differentiates itself through AI, privacy tools, and gamified NFT mechanics. Let’s look at how it compares:

RealT

Focus: U.S. rental properties Strength: Proven legal frameworks, stable returns via rent Weakness: No AI, no NFTs, limited global scope

HoneyBricks

Focus: U.S. commercial real estate Strength: Compliant with U.S. securities laws, backed by large assets Weakness: Requires accredited investor status, limited accessibility

RealOpen

Focus: Luxury real estate transactions using crypto Strength: Celebrity-endorsed, slick front-end Weakness: No token ecosystem, not community-owned

$SOTT

Focus: Global, tokenized real estate with AI integration Strengths: AI-driven platform Passive income NFTs ZK-privacy layer Cashback + profit-sharing Weaknesses: Not yet on major listings Inaccessible website (as of May 2025) Regulatory risks pending

Risks to Consider

Investing in $SOTT carries typical early-stage crypto project risks:

Lack of CEX listings limits liquidity and visibility. Regulatory uncertainty in both crypto and real estate sectors. Project reliability, given the temporary website inaccessibility. Market volatility, as $SOTT may fluctuate with the broader altcoin cycle.

The absence from major platforms like CoinGecko and CoinMarketCap is a double-edged sword: it’s underexposed (bullish for early adopters) but also unvetted (caution required).

Why $SOTT Is Worth Watching

What gives $SOTT potential is its synthesis of real-world asset access and crypto-native tools:

It lets users invest in real estate without banks, borders, or bureaucracy. It adds crypto-native features like royalty-generating NFTs and AI utility layers. It promotes low-barrier entry through fractional investing.

While it’s still early, $SOTT aligns with long-term trends predicted by analysts like Deloitte, who estimate the tokenized real estate market could reach $4–16 trillion by 2030.

Final Thoughts

$SOTT is still finding its footing, but its mix of blockchain, AI, and real estate could unlock a new era of property investment. With a focus on accessibility, security, and decentralized rewards, it positions itself as a standout project in a fast-growing niche.

Whether it will succeed depends on adoption, execution, and regulatory navigation. But if you’re looking to get in on the next wave of crypto RWA projects, $SOTT is worth adding to your watchlist.

For more information, visit https://sott.pro or follow updates from the team on X at @PeraniumP.

SOTT crypto token, real estate blockchain token, fractional property investing, AI real estate crypto, tokenized real estate 2025, passive income NFTs, real estate royalty tokens, mobile real estate crypto app, zero knowledge proofs real estate, RWA crypto trend, real estate crypto platforms, crypto property investing, $SOTT token analysis, DeFi real estate projects, HoneyBricks vs SOTT, RealT token comparison, real estate NFT revenue, crypto marketplace property token, SOTT mobile app features, crypto real estate innovation, blockchain real estate 2025, decentralized property investing, voice assistant crypto platform, smart real estate investments, SOTT profit sharing, fractional real estate token, crypto construction project token, real estate investing Web3, ZK privacy in real estate.

- ASTRAL Token Review$ASTRAL Token Review (2026): Astral Gate’s Vision for Secure Cross-Chain DeFi Cross-chain interoperability remains one of the biggest challenges in decentralized finance. As capital fragments across Ethereum, BNB Chain, Arbitrum, Base, and other networks, users are left navigating complex bridges, high fees, and persistent security risks. Astral Gate is an emerging DeFi project aiming to… Read more: ASTRAL Token Review

- $MYUSIC$MYUSIC: The Underdog Token Powering AI Music in Web3 In the intersection of AI, music, and blockchain, a small but ambitious project is starting to stand out: Myusic AI and its native Ethereum token, $MYUSIC. Built around text-to-song generation and Web3 ownership tools, Myusic aims to democratize music creation for anyone—especially emerging creators who lack… Read more: $MYUSIC

- YUUKI — The WildcardYUUKI — The Wildcard Rising in #GambleFi In the fast-moving frontier where blockchain meets entertainment, new contenders are quietly rewriting what online gaming can be. One of the most intriguing names to emerge in 2025 is $YUUKI, the utility token powering the Fullhouse.gg ecosystem — an ambitious AI-driven crypto-casino built on the Base network. At… Read more: YUUKI — The Wildcard

- Unlocking the Beat🔓 Unlocking the Beat: How $BEAT Token Is Revolutionizing Web3 Music and NFTs 🎧 Introduction In today’s fragmented music industry, creators face outdated royalty systems, limited access to opportunities, and centralized platforms that take a massive cut. But a new solution is emerging at the intersection of blockchain, artificial intelligence, and digital ownership. Meet $BEAT… Read more: Unlocking the Beat

- BERT$BERT is emerging as Solana’s most promising meme coin — blending charity, AI utility, and community loyalty. This analysis compares $BERT with $BONK, $WIF, $POPCAT, and $TRUMP to reveal how its sentiment, story, and grassroots support position it as the next Solana leader.

- EyeTechEyeTech ($EYE): The AI-Powered Future of Trading on Solana The Solana ecosystem has often been labeled as the playground for memecoins and fast-moving speculative assets, but beneath the surface lies a new generation of serious, utility-driven innovators. Among them, EyeTech stands out as one of the most forward-thinking and long-lasting projects building real value on… Read more: EyeTech

- Propchain🏠 Propchain ($PROPC): Real Estate Meets Web3 Ownership Propchain stands at the intersection of real estate and decentralized finance, aiming to bring one of the world’s oldest and most valuable asset classes fully on-chain. The project focuses on making property investment transparent, fractional, and accessible to a global audience through blockchain tokenization. 🌍 The Vision… Read more: Propchain

- $5,000,000 Jackpot🚨 Evojacks Breaks Its Own Record: $5 → $5,000,000 Jackpot Approved 🚨 The Million-Dollar Website just redefined what’s possible. @Evojackscom has officially announced a record-shattering upgrade — the brand-new $5 → $5,000,000 Instant Jackpot Game, set to launch the day after the platform’s official debut. This isn’t just another jackpot — it’s the next evolution… Read more: $5,000,000 Jackpot

- The GambleFi Frontier🎰 The GambleFi Frontier: From Mid-Caps to Micro-Caps in 2025 The fusion of gaming, betting, and decentralized finance has given birth to a powerful new sector — GambleFi. In 2025, projects spanning casinos, lotteries, sports betting, and meme-driven ecosystems are competing for dominance. From the mid-cap pillars like Rollbit ($RLB) and Shuffle ($SHFL) to emerging… Read more: The GambleFi Frontier