AVAX in 2025: Avalanche’s Rise Through Subnets, Speed, and Staking

At CryptoUpdates.blog, we cover everything from blue-chip giants like $AVAX to promising microcaps. Understanding how leaders evolve helps us evaluate whether emerging tokens add real value—or just mimic what’s already dominant.

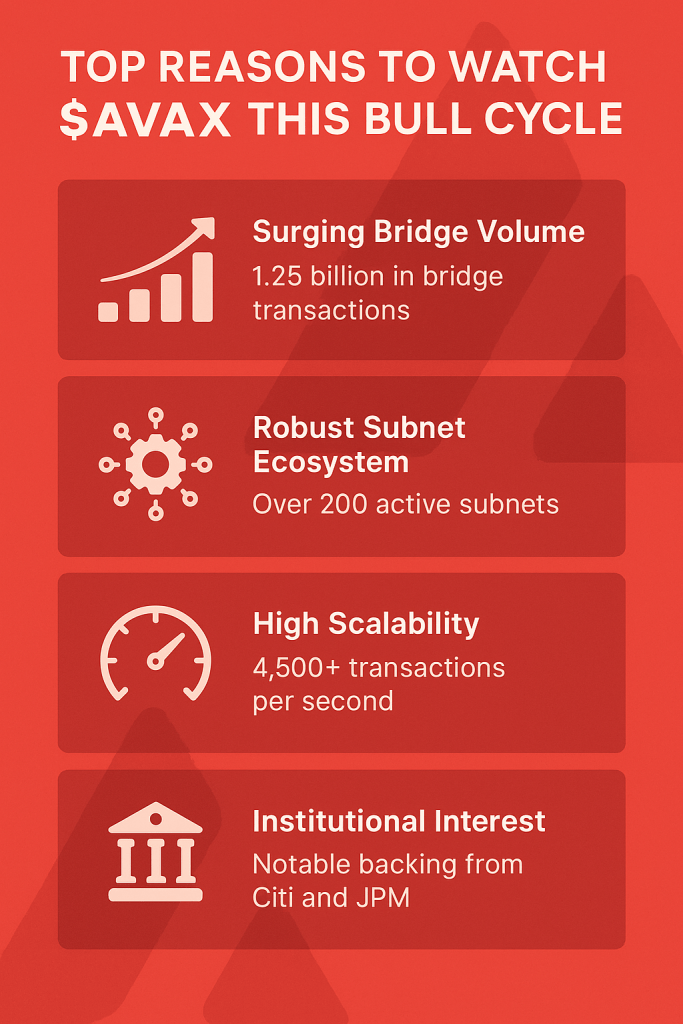

As of July 19, 2025, Avalanche’s native token $AVAX is gaining traction again in the broader Layer 1 blockchain race. Recent reports from DefiLlama show Avalanche leading all blockchains in bridge volume with $1.25 billion, outpacing Solana and stirring debate on which ecosystem is truly best positioned for the bull cycle.

But behind the headlines lies a deeper story—one of architectural advantage, ecosystem expansion, and a unique staking structure that might put Avalanche ahead in the long game.

The Avalanche Advantage: Speed, Subnets, and Finality

Avalanche, launched by Ava Labs in 2020, built its reputation on unmatched scalability. Unlike traditional blockchains like Bitcoin or Ethereum, Avalanche uses a novel consensus model called the Snow family of protocols—offering fast finality (under 2 seconds) and high throughput across its modular network.

Rather than relying on a single monolithic chain, Avalanche uses three core chains:

The X-Chain for asset creation The C-Chain, which supports Ethereum-compatible smart contracts The P-Chain, responsible for staking, validators, and subnet coordination

But the real power lies in subnets—custom, application-specific blockchains that plug into Avalanche while maintaining independence. Whether it’s DeFi, gaming, or enterprise solutions, each subnet can be optimized for performance and compliance, without congesting the core network.

By mid-2025, Avalanche now hosts over 200 active subnets, supporting projects across AI, gaming, and institutional finance.

Why Avalanche Is Dominating the 2025 Bridge Race

This month’s bridge volume—surpassing $1.25 billion—offers more than just a statistic. It reflects trust in Avalanche’s cross-chain capabilities and its positioning as a neutral ground for token flows between chains.

According to influencer Valentin Romascu on X, Avalanche now leads over Solana (currently reporting $461 million in bridge volume), a remarkable shift from 2024’s narrative when Solana was the dominant “Ethereum killer.”

Institutional adoption plays a role as well. Firms like JPMorgan and Citi have been quietly testing Avalanche-based infrastructures, according to Messari’s 2023 research. Meanwhile, subnet launches tied to real-world assets and gaming studios have drawn new users and liquidity to the chain—key catalysts during a time when market capital is selective.

Staking, Burn Mechanism, and Ecosystem Health

Validators on Avalanche must stake a minimum of 2,000 AVAX, creating a robust economic moat for network security. But unlike many networks that dilute their supply, Avalanche employs a burn mechanism—destroying fees to limit inflation and create deflationary pressure over time.

$AVAX isn’t just a staking token. It powers subnet creation, governance, smart contracts, gas fees, and bridges—making it deeply integrated into all activity on the network. With transaction speeds above 4,500 TPS per subnet and low fees, the chain has increasingly attracted developers frustrated by congestion or cost issues on Ethereum and Solana.

Where the Market Is Heading: Price and Prognosis

Technically, AVAX is showing bullish momentum. Both its 50-day and 200-day moving averages are trending upward, and trading sentiment on X has grown more optimistic. Forecasts range widely—Digital Coin Price sees a slow climb toward $30, while others like Lark Davis believe triple digits aren’t out of reach if Avalanche maintains ecosystem growth.

The 131% gain over the last 30 days reflects more than hype. It’s a sign that traders are waking up to Avalanche’s evolving role in the post-2024 crypto landscape—one shaped by application-specific networks, real-world asset bridges, and modular scalability.

Risks and Headwinds

Still, it’s not all smooth sailing. Avalanche faces pressure from Solana’s superior single-chain TPS and Ethereum’s maturing rollup ecosystem. Regulatory attention on bridge protocols has also intensified following cross-chain vulnerabilities earlier in Q1 2025.

The Avalanche Foundation’s 2025 roadmap emphasizes interoperability improvements, greater subnet communication, and new tooling for developers. But execution will be critical. If competitors match or exceed Avalanche’s modular benefits, the race could tighten.

Conclusion: Why $AVAX Still Matters

Avalanche isn’t just another Layer 1—it’s becoming a modular hub for everything from institutional staking to blockchain gaming. Its architectural flexibility, coupled with eco-conscious design and growing adoption, positions $AVAX as one of the most strategic assets in the market today.

Whether or not the price hits $30 or $100 in 2025, one thing is clear: Avalanche is building something that could last. For investors, developers, and institutions, understanding the subnet strategy and staking economics may prove to be one of the most important steps in navigating this bull cycle.

Stay informed, stay critical—and keep $AVAX on your radar.

AVAX token, Avalanche crypto, Avalanche blockchain, AVAX price prediction, AVAX bridge volume, Avalanche subnet, AVAX staking, best Layer 1 blockchain, DAG blockchain, AVAX vs Solana, smart contract platform, Avalanche vs Ethereum, DeFi on Avalanche, C-Chain Avalanche, P-Chain staking, X-Chain assets, Avalanche validator, AVAX future outlook, AVAX bull run 2025, fastest blockchain, EVM-compatible blockchain, Avalanche TPS, Avalanche gaming, AVAX 2025 price, Avalanche scalability, Avalanche sustainability, institutional crypto adoption, crypto staking 2025, cross-chain bridge crypto, Snow protocol, AVAX burning, AVAX market analysis, AVAX vs Ethereum rollups, Avalanche AI integration, AVAX ecosystem, Avalanche crypto news, crypto market trends 2025, Avalanche Foundation roadmap, crypto bullish signals, crypto price breakout 2025, Avalanche subnet advantages, DeFi platforms 2025, AVAX investment 2025, crypto technical analysis.

- New Millionaire Games

EvoJacks Launches New Millionaire Games With Free Testing Weekend EvoJacks.com is entering a new phase. Later this week, the platform will roll out a brand-new suite of Millionaire Games, all built fully in-house and designed around a single, bold idea: familiar casino formats, re-engineered for extreme upside. At the center of the upcoming launch is… Read more: New Millionaire Games

EvoJacks Launches New Millionaire Games With Free Testing Weekend EvoJacks.com is entering a new phase. Later this week, the platform will roll out a brand-new suite of Millionaire Games, all built fully in-house and designed around a single, bold idea: familiar casino formats, re-engineered for extreme upside. At the center of the upcoming launch is… Read more: New Millionaire Games - ASTRAL Token Review

$ASTRAL Token Review (2026): Astral Gate’s Vision for Secure Cross-Chain DeFi Cross-chain interoperability remains one of the biggest challenges in decentralized finance. As capital fragments across Ethereum, BNB Chain, Arbitrum, Base, and other networks, users are left navigating complex bridges, high fees, and persistent security risks. Astral Gate is an emerging DeFi project aiming to… Read more: ASTRAL Token Review

$ASTRAL Token Review (2026): Astral Gate’s Vision for Secure Cross-Chain DeFi Cross-chain interoperability remains one of the biggest challenges in decentralized finance. As capital fragments across Ethereum, BNB Chain, Arbitrum, Base, and other networks, users are left navigating complex bridges, high fees, and persistent security risks. Astral Gate is an emerging DeFi project aiming to… Read more: ASTRAL Token Review - $MYUSIC

$MYUSIC: The Underdog Token Powering AI Music in Web3 In the intersection of AI, music, and blockchain, a small but ambitious project is starting to stand out: Myusic AI and its native Ethereum token, $MYUSIC. Built around text-to-song generation and Web3 ownership tools, Myusic aims to democratize music creation for anyone—especially emerging creators who lack… Read more: $MYUSIC

$MYUSIC: The Underdog Token Powering AI Music in Web3 In the intersection of AI, music, and blockchain, a small but ambitious project is starting to stand out: Myusic AI and its native Ethereum token, $MYUSIC. Built around text-to-song generation and Web3 ownership tools, Myusic aims to democratize music creation for anyone—especially emerging creators who lack… Read more: $MYUSIC - YUUKI — The Wildcard

YUUKI — The Wildcard Rising in #GambleFi In the fast-moving frontier where blockchain meets entertainment, new contenders are quietly rewriting what online gaming can be. One of the most intriguing names to emerge in 2025 is $YUUKI, the utility token powering the Fullhouse.gg ecosystem — an ambitious AI-driven crypto-casino built on the Base network. At… Read more: YUUKI — The Wildcard

YUUKI — The Wildcard Rising in #GambleFi In the fast-moving frontier where blockchain meets entertainment, new contenders are quietly rewriting what online gaming can be. One of the most intriguing names to emerge in 2025 is $YUUKI, the utility token powering the Fullhouse.gg ecosystem — an ambitious AI-driven crypto-casino built on the Base network. At… Read more: YUUKI — The Wildcard - Unlocking the Beat

🔓 Unlocking the Beat: How $BEAT Token Is Revolutionizing Web3 Music and NFTs 🎧 Introduction In today’s fragmented music industry, creators face outdated royalty systems, limited access to opportunities, and centralized platforms that take a massive cut. But a new solution is emerging at the intersection of blockchain, artificial intelligence, and digital ownership. Meet $BEAT… Read more: Unlocking the Beat

🔓 Unlocking the Beat: How $BEAT Token Is Revolutionizing Web3 Music and NFTs 🎧 Introduction In today’s fragmented music industry, creators face outdated royalty systems, limited access to opportunities, and centralized platforms that take a massive cut. But a new solution is emerging at the intersection of blockchain, artificial intelligence, and digital ownership. Meet $BEAT… Read more: Unlocking the Beat - BERT$BERT is emerging as Solana’s most promising meme coin — blending charity, AI utility, and community loyalty. This analysis compares $BERT with $BONK, $WIF, $POPCAT, and $TRUMP to reveal how its sentiment, story, and grassroots support position it as the next Solana leader.

- EyeTechEyeTech ($EYE): The AI-Powered Future of Trading on Solana The Solana ecosystem has often been labeled as the playground for memecoins and fast-moving speculative assets, but beneath the surface lies a new generation of serious, utility-driven innovators. Among them, EyeTech stands out as one of the most forward-thinking and long-lasting projects building real value on… Read more: EyeTech

- Propchain🏠 Propchain ($PROPC): Real Estate Meets Web3 Ownership Propchain stands at the intersection of real estate and decentralized finance, aiming to bring one of the world’s oldest and most valuable asset classes fully on-chain. The project focuses on making property investment transparent, fractional, and accessible to a global audience through blockchain tokenization. 🌍 The Vision… Read more: Propchain

- $5,000,000 Jackpot🚨 Evojacks Breaks Its Own Record: $5 → $5,000,000 Jackpot Approved 🚨 The Million-Dollar Website just redefined what’s possible. @Evojackscom has officially announced a record-shattering upgrade — the brand-new $5 → $5,000,000 Instant Jackpot Game, set to launch the day after the platform’s official debut. This isn’t just another jackpot — it’s the next evolution… Read more: $5,000,000 Jackpot

- The GambleFi Frontier🎰 The GambleFi Frontier: From Mid-Caps to Micro-Caps in 2025 The fusion of gaming, betting, and decentralized finance has given birth to a powerful new sector — GambleFi. In 2025, projects spanning casinos, lotteries, sports betting, and meme-driven ecosystems are competing for dominance. From the mid-cap pillars like Rollbit ($RLB) and Shuffle ($SHFL) to emerging… Read more: The GambleFi Frontier